bexar county tax assessor payment

Mailed in October for. After locating the account you can pay online by credit card or eCheck.

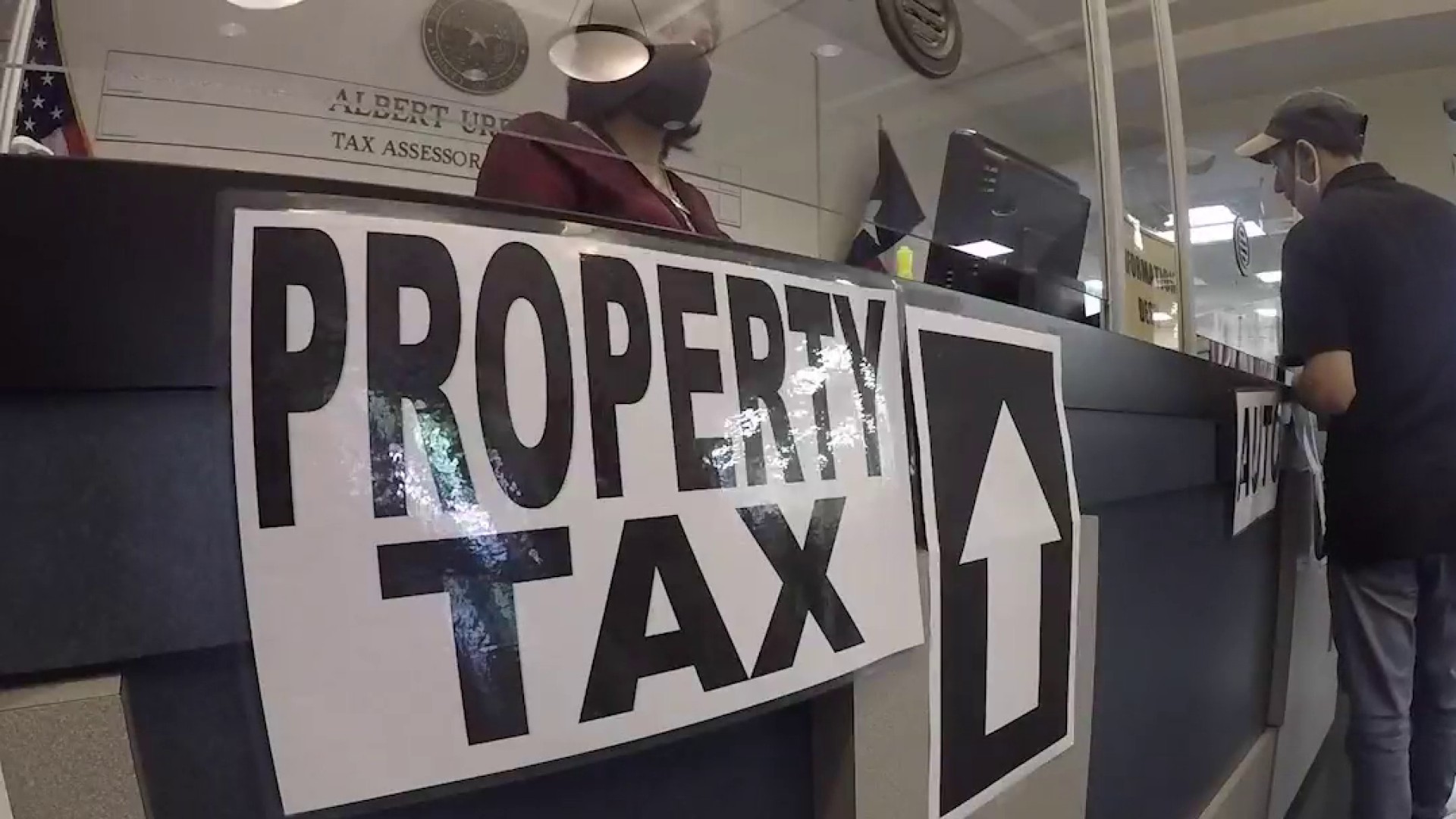

Property Tax Information Bexar County Tx Official Website

Thank you for visiting the Bexar County ePayment Network.

. San Antonio TX 78205. Job Opportunities with Bexar County. Bexar County Tax Assessor-Collector Office P.

Acceptable forms of payment vary by county. Find Information On Any Bexar County Property. Bexar County Tax Office.

Monday - Friday 745 am - 430 pm Central Time. Ad Scan Bexar County Property Records for the Real Estate Info You Need. Bexar Appraisal District is responsible for appraising all real and business personal property within Bexar County.

As a property owner your most important right is your right to protest. City of San Antonio Property Taxes are billed and collected by the Bexar County Tax Assessor-Collectors Office. You can search for any account whose property taxes are collected by the Bexar County Tax Office.

Due to a change in the statue participating jurisdictions may elect to turn over their delinquent business. Enter an account number owners name last name first address. After locating the account you can pay online by credit card or eCheck.

Such as participating grocery stores. Disabled person exemption Age 65 or Over exemption. How was your experience with papergov.

Please follow the instructions below. Bexar County Directory. Offered by County of Bexar Texas.

For additional information regarding the appeal process please contact the Bexar Appraisal District at 210-224-8511 to speak to one of their appraisers. A statement bill will be. Please select the type of payment you are interested in making from the options below.

You can search for any account whose property taxes are collected by the Bexar County Tax Office. Clicking on the link below will take you to to a webpage with specific information and instructions for making that type of payment through our convenient and secure online network. The deadline each year is May 15th or 30 days after the notice is mailed whichever is later.

Offered by County of Bexar Texas. The district appraises property according to the Texas Property Tax Code and the Uniform Standards of. In the event a property owner disagrees with their assessed value a protest may be filed with their appraisal district.

Box 839950 San Antonio TX 78283-3950. For additional information regarding the appeal process please contact the Bexar Appraisal District at 210-224-8511 to speak to one of their appraisers. Property taxes must be current Equal payments are due.

The Pre-Payment Plan allows Homeowners and Business Owners without a mortgage escrow account to pre-pay their taxes in monthly installments through September 15. Other locations may be available. Offered by County of Bexar Texas.

In order to be timely payment mailing or common carrier of taxes must be postmarked or receipted on or before the due date of January 31st. The City of San Antonio has an interlocal agreement with the Bexar County Tax Assessor-Collectors Office to provide. This service includes filing an exemption on your residential homestead property submitting a Notice of Protest and receiving important notices and other information online.

Depending on start date. 100 Dolorosa San Antonio TX 78205 Phone. County tax assessor-collector offices provide most vehicle title and registration services including.

You can search for any account whose property taxes are collected by the Bexar County Tax Office. Ad Submit Your County Of Bexar Payment Online with doxo. The 10-Month Payment Plan applies to a property the person occupies as a residential homestead with one of the following exemptions.

Commissioners Court Broadcast Agendas. After locating the account you can also register to receive certified statements by e-mail. Within this site you will find information about the ad valorem property tax system in Texas and Bexar County property details.

San Antonio TX 78283-3966. Please contact your county tax office or visit their Web site to find the. After locating the account you can also register to receive certified statements by e-mail.

The Bexar County Tax Assessor-Collectors Office is the only County in the State of Texas with a 10-month payment plan. The Online Services Portal is available to ALL owners that would like to conduct business with the Appraisal District electronically. 100 Dolorosa San Antonio TX 78205 Phone.

100 Dolorosa San Antonio TX 78205 Phone. Of each tax year without penalty or interest. The Online Portal is also available.

As a property owner your most important right is your right to protest your assessed value.

Nelda Martinez On Twitter Bexar County San Antonio Tx Corpus Christi

Bexar County Careers And Employment Indeed Com

Payments Bexar County Tx Official Website

Showlist Bexar County Good Customer Service Acting

Public Service Announcement Residential Homestead Exemption

Calendar Bexar County Tx Civicengage

Chief Appraiser Expects A New Record Of Appeals To Be Filed Next Week In Bexar County

County Commissioners Vote To Decrease Property Tax Rate In 2022

As Property Tax Bills Arrive Protesters Are Encouraged To Act Now Woai

Bexar County Property Owners Have Until May 17 To Appeal 2021 Property Appraisals Officials Say

Bexar County Tax Assessor 233 N Pecos St San Antonio Tx Tax Consultants Mapquest

Bexar County Considers 2 8b Budget Raises For Employees Officials

Property Tax Information Bexar County Tx Official Website

Bexar County Offers Aid To Delinquent Property Taxpayers Community Impact

:strip_exif(true):strip_icc(true):no_upscale(true):quality(65)/cloudfront-us-east-1.images.arcpublishing.com/gmg/FIN4Q7VOD5GDFMHBKTNEEM7YCY.jpg)