who pays sales tax when selling a car privately in michigan

Nov 3 2022 2 min read Texans who buy a used vehicle from anyone other than a licensed vehicle dealer are required to pay motor vehicle sales tax of 625 percent on the. Thats why the fact that the sales tax will go on the federal governments website next month is the most important thing happening in Washington right now.

How To Register For A Sales Tax Permit In Michigan Taxvalet

For example a service whos work includes.

. In Michigan a title transfer requires a. In the vast majority of circumstances selling your old car to a private party or to a dealer shouldnt bring a tax bill with it. Michigan requires a 6 use tax be paid by the seller on all private vehicle sales unless you are transferring the title to someone with a tax exempt status.

While most services are exempt from tax there are a few exceptions. Michigan collects a 6 state sales tax rate on the purchase of all vehicles. A recent study by.

It is needed whenever you buy a car from a private seller as opposed to a dealer. Selling a Junk Car in. For transactions occurring on and after October 1 2015 an out-of-state seller may be required to remit sales or use tax on sales into Michigan if the seller has nexus under amendments to the.

The Michigan Department of Treasury. The buyer will have to pay the sales tax when they. The buyer will pay sales tax on the purchase price.

If you spend 7000 on a car and an additional 1000 on improvements but you sell the car for 7000 its considered a capital loss and you dont need to pay tax on the sale. If a vehicle is purchased from an Indiana dealership the dealer will collect the sales tax and provide proof of the sales tax paid on an ST108 Certificate of Gross Retail or Use Tax Paid. In the state of Michigan services are not generally considered to be taxable.

For example theres a state sales tax on the purchase of automobiles which is 725 and additional county taxes apply. As an example if you purchase a truck from a private party for. Private vehicle transactions in Michigan require a 6 tax due on the full purchase price or fair market value of the vehicle whichever is greater.

You can make another deduction on top of that. You can either pay the sales tax when buying a car privately or you can pay the tax if you are renting a car. Buying a car or any other motor vehicle is a taxable transaction.

Car Sales Tax on Private Sales in Michigan A sales tax is required on all private vehicle sales in Michigan. It should contain important information including the purchase price of the vehicle the sale date a. If you are buying or selling a car for the first time you may be unaware of how taxes are paid for this type of transaction.

Capital gains are either over the long or short term over the short. Title transfers must take place within 30 days from the date of sale otherwise a late penalty fee will be charged. The IRS considers all personal vehicles capital assets.

The sales tax you originally paid when purchasing the car. Private The Ultimate Cheat Sheet on who pays sales tax when selling a. After all a title transfer comes with fees and paperwork and car ownership comes with its own regular costseven if the vehicle is a gift.

For vehicles that are being rented or leased see see taxation of leases and rentals. In addition to taxes car. The buyer is responsible for paying the sales tax according to the sales tax rate in the jurisdiction where you sell the vehicle.

Toyota of Naperville says these county taxes are far.

Sales Taxes In The United States Wikipedia

How To Sell A Car In Michigan What The Sos Needs From Sellers

Free Michigan Motor Vehicle Bill Of Sale Pdf Word Eforms

What Paperwork Do I Need To Sell My Car Privately Privateauto

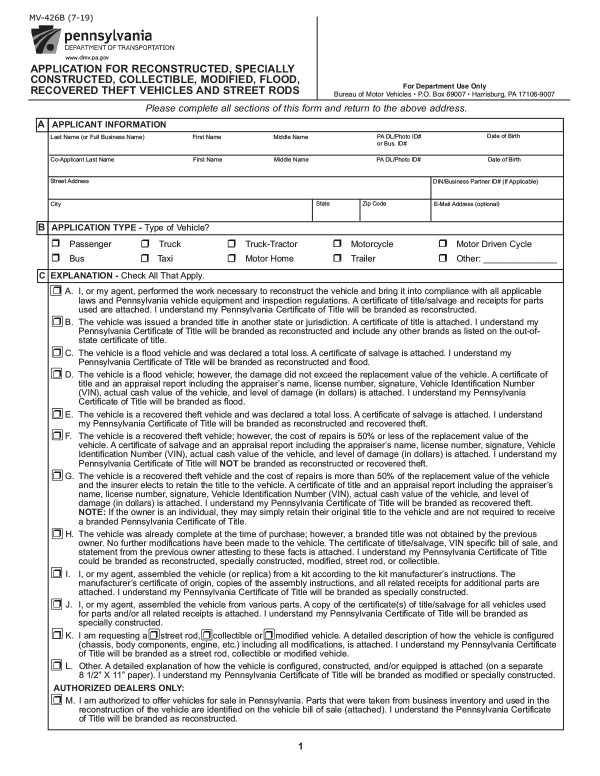

Bills Of Sale In Pennsylvania All About Pa Forms And Facts You Need

Michigan Sales Tax On The Difference For Trade Ins Means More Money For You

13 Printable Vehicle Purchase Agreement With Monthly Payments Forms And Templates Fillable Samples In Pdf Word To Download Pdffiller

:max_bytes(150000):strip_icc()/states-without-a-sales-tax-3193305-final1-5b61ead946e0fb0025def3b3-f3af8012647b4d2498dd1cabea5092e0.png)

States With Minimal Or No Sales Taxes

How To Safely Sell A Car In A Few Simple Steps State Farm

7 Steps How To Get A Michigan Car Dealer License Surety Solutions A Gallagher Company

Free Bill Of Sale Forms 24 Word Pdf Eforms

Do You Have To Pay Taxes When You Buy A Car Privately Privateauto

Michigan Laws About Private Used Car Sales

If I Buy A Car In Another State Where Do I Pay Sales Tax

Illinois Imposing Car Trade In Tax On Jan 1 Dealers Call It Double Taxation

If I Buy A Car In Another State Where Do I Pay Sales Tax

Used Cars In Michigan For Sale Enterprise Car Sales

Do You Have To Pay Taxes When You Buy A Car Privately Privateauto

Is It Better To Buy A Car In Nj Or Pa Nj State Auto Used Cars Blog